Adapter vos programmes à l’étranger

Mission, détachement, expatriation, contrat local, nous vous accompagnons dans les couvertures de vos salarié(e)s à l’étranger et vous apportons une vision globale des couvertures de protection sociale de chacun des pays dans lesquels votre entreprise est présente.

de français à l’étranger (inscrits au registre consulaire)

vivants à l’étranger sont installés en Europe (UE et hors UE)

françaises sont implantées à l’étranger

Harmoniser votre politique sociale

La vision globale de la protection sociale de vos salariés à l’étranger

Protéger vos salarié(e)s français à l’étranger

En matière de protection sociale, les besoins et obligations varient significativement d’un pays à l’autre. Chesneau propose une couverture complète pour vos salarié(e)s français à l’étranger (Assistance, Prévoyance, Santé, Retraite, …).

Quel que soit le pays de destination, et le statut de vos salarié(e)s à l’étranger (Mission, Détachement, Expatriation), vos obligations, comme les couvertures et l’accès aux soins diffèrent.

Grâce à notre partenariat avec le réseau UNIBA Partners, bénéficiez d’une expertise sur les réglementations spécifiques à chaque pays et d’un accompagnement dans la mise en place des garanties les plus adaptées aux besoins de vos salarié(e)s à l’international.

Coordonner vos régimes dans tous les pays

Face à la diversité des modèles de protection sociale dans le monde, Chesneau, en partenariat avec le réseau UNIBA Partners, permet la lecture de vos régimes locaux grâce à un accompagnement en plusieurs étapes :

- Audit des régimes locaux en place, afin de vérifier la conformité des polices avec la réglementation et les pratiques des marchés,

- Adaptation des polices locales ou des organismes d’assurances locaux à la politique retenue en lien régulier avec l’entité française,

- Pilotage des contrats en cours,

- Mise en place de programmes internationaux mutualisés (pooling).

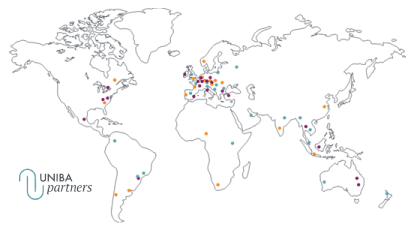

La force de notre partenaire de référence à l’international : UNIBA Partners

Chesneau a rejoint en 2019 UNIBA Partners, réseau de courtiers indépendants présents dans 130 pays. Ce partenariat nous permet de renforcer notre offre de services auprès de nos clients dont l’activité se développe à l’international.

Grâce au réseau Uniba Partners, bénéficiez d’une expertise sur vos filiales à l’étranger, aussi bien sur le volet dommage aux biens, responsabilité, que sur la couverture sociale de vos salariés.

Vos questions

Informations complémentaires sur la protection sociale à l’international